Rental rates are driven by a variety of supply and demand factors which make up a separate market for rentable space. As investors consider an acquisition, they must project future movements of this market as it relates to the specific asset. If the space market is expected to yield future increases in rental rates, investors will pay a higher price for the current income stream, pushing the cap rate down. If the space market projects a weak outlook, investors will want to pay less, and cap rates will rise. We consider the market value of assets prevailing in the market at the time of calculation instead of book value.

Return on investment indicates what the potential return of an investment could be over a specific time horizon. The capitalization rate will tell you what the return of an investment is currently or what it should actually be. Generally, the capitalization rate can be viewed as a measure of risk. So determining whether a higher or lower cap rate is better will depend on the investor and their risk profile.

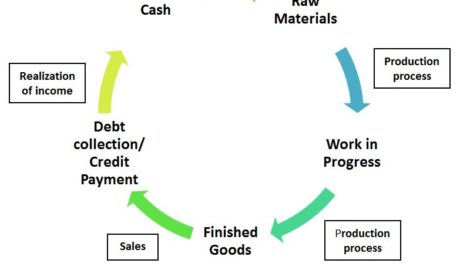

One can highlight upon the justification of the amount of capitalization by considering the earning of the concern. According to this theory a projected Balance Sheet is prepared. The sum of amounts of all items to be shown on the assets side of the projected Balance Sheet is taken as the amount of capitalisation. S. Dewing, “capitalization is the sum total of the par value of all shares”. Cash FlowCash Flow is the amount of cash or cash equivalent generated & consumed by a Company over a given period. It proves to be a prerequisite for analyzing the business’s strength, profitability, & scope for betterment.

Disadvantages of Utilizing Capitalization Rate

Apparently, policymakers and banks played a crucial role in the housing boom by providing easy access for mortgage loans. As a result of innovations in the financial sector and low interest rates, mortgage loans flooded the housing market. The increasing demand with easy credits generated house price inflation, and capitalization rates fell to unprecedented levels. Put simply, cap rate definition is the rate of return on a real estate investment property. In other words, it describes what part of your initial investment will return to you every year. Capitalization refers to a few different things across business.

A cap rate above 7% may be perceived as a riskier investment, whereas a cap rate below 5% may be seen as a safer bet. If a property has a 10% cap rate, you should expect to recover your investment in about 10 years. Once you have the cap rate, you can use it to examine the investment’s risk.

With that being said, most rental investors target properties with a cap rate of 4-8%. Properties with a cap rate of less than 4% may be in great areas, but their returns are typically sub-par relative to their high values. On the other hand, properties with cap rates above 8% can have high cash flow, but are usually more risky and management-intensive.

- We note that this ratio has increased for most Oil & Gas companies.

- You can use the cap rate to determine how risky the investment is and how long it will take to recover your initial purchase.

- So the three ratios that we will look at are – Debt-Equity Ratio, Long-term Debt to Capitalization Ratio, and Total Debt to Capitalization Ratio.

Forecasts are to be made in respect of preliminary expenses, fixed assets and working capital. Here, total debt is given, and we also know the shareholders’ equity. EBIT Vs. EBITDAEBIT signifies the operating profit the company makes before the inclusion of interest and tax expenses. In comparison, EBITDA determines the company’s overall operational profitability by summing the depreciation and amortization expenses to the operating profit. Financial LeverageFinancial Leverage Ratio measures the impact of debt on the Company’s overall profitability. Moreover, high & low ratio implies high & low fixed business investment cost, respectively.

On our tax returns, we probably show a loss of more than $30,000 in 2019. Clever’s Concierge Team can help you compare local agents and negotiate better rates. But real success means understanding the local markets you serve—which is why we bring the business solutions, insights and market perspective you need. Using the same example from above, we’d see the net operating income change to $60,000 if we apply a 90% occupancy rate.

How Does Capitalization Rate Work?

You can make predictable cash flow in a recession-resistant asset. High down payments hold many people back, but Smartland can help. Real estate investing provides cash flow, appreciation, tax benefits, and other perks. You’ll have to review deals, assess valuations, and come up with enough money for a down payment.

These, in turn, affect the capitalization rate, which can either increase or decrease . It can also be used to compare real estate investments as an asset class to another asset class, such as equity or debt instruments. The reason it’s called the “capitalization” rate is that it can be used to derive the property value from its cash flows. This number typically does not consider debt – only equity – but debt can be added to make more accurate predictions. Operating expenses include costs we incur to operate and maintain properties in order to earn income from them. It includes property taxes, maintenance fees, insurance premiums, etc.

Under capitalization defined by Gerstenberg, “a corporation may be under-capitalized when the rate of profit is exceptionally high in the same industry”. Under-capitalisation is just the reverse of over-capitalisation capitalization rate but it should never be taken to indicate deficiency or inadequacy of capital. The stage of under-capitalisation arises when the concern starts earning at a rate higher than current rate.

The next step is to find the cap rates of similar, previously sold properties in the same area. An average cap rate lower than 5% for similar properties indicates a bargain. Capitalization Rate can be defined as the rate of return for an investor investing money in real estate properties based on the Net Operating Income that the property generates.

FAQs about capitalization rates

In another version, the figure is computed based on the original capital cost or the acquisition cost of a property. You can start using DealCheck to analyze investment properties for free online, or by downloading our iOS or Android app to your mobile device. Their data provider at the time was “deficient, even limiting the number of properties I could search,” says Stav Stern, an Investment Agent at Stonehenge. This easy-to-access, high-quality data is precisely what drew Manhattan real estate firm Stonehenge to Reonomy. Find out everything there is to know about potential costs and issues that might arise, from zoning and tax laws to nearby transportation.

This article explains how to use cap rates to your advantage — and even contains two free cap rate calculators you can use to model deals. The cap rate is used to convert a point estimate of cash flow into value. The inverse of a capitalization rate is referred to as the multiple. Capital liquidity measures how much you invest into a property. These investments will increase your expenses, lowering net operating income in the process. Is your property in a reliable area or a boom-or-bust location?

This seems to be a decent property in pretty good condition, but a new HVAC and roof will be expensive. Were I to set aside an escrow fund to cover these expenses, Property A’s cap rate would fall below the typical 6% I can find in this area. Prepare for future growth with customized loan services, succession planning and capital for business equipment or technology. Generating cash flow from real estate allows you to retire sooner and develop a backup income stream. Class B properties are those in between Class A and C properties.

It is calculated by multiplying the price of the company’s shares by the number of shares outstanding in the market. Asset ClassAssets are classified into various classes based on their type, purpose, or the basis of return or markets. It can also be thought of as return on investment an investor will receive annually on the purchase of real estate property. The capitalization rate should be used in conjunction with other metrics and investors should never base a purchase on the capitalization rate of a property alone. The capitalization rate can be used to determine the riskiness of an investment opportunity – a high capitalization rate implies higher risk while a low capitalization rate implies lower risk.

Sample of metro-level average cap rates

Most investors predict what NOI will be in a year, but some look further out. The further you lookout, the more uncertain your predictions become. If investors make inaccurate guesses about the property’s future NOI and the property underperforms, investors can significantly overpay without knowing. By the time investors figure out they overpaid, they already own the property. Finding the perfect location is crucial for commercial real estate. The right location brings in more business, increasing profit for tenants and investors.

Without question, if you’re not familiar with the definitions or formulas, it can be overwhelming and challenging to know which ones you should pay the most attention to. The risk-free rate is the rate of return provided on a treasury bond. Treasury bonds are considered risk free because they are backed by the US government. In this approach, the guideline is the estimation of the expenses for constructing a similar property taking into account the depreciation rates and land values. A capital asset is an asset with a useful life longer than a year that is not intended for sale in the regular course of the business’s operation.

On the other hand, increasing cap rates may indicate that the property values are dropping due to declining demand and worsening economic conditions in that market. If the property’s net operating income is complex or irregular, with significant variations in cash flow, a discounted cash flow analysis is needed to determine a credible and reliable valuation. A property’s cap rate is one of the most fundamental measures of its potential value to investors, yet the measurement is still widely misunderstood. Cap rate is used primarily by long-term investors looking to purchase property for rental purposes. In addition to long-term investors, landlords and commercial investors will consider the cap rate when evaluating a property. We now know the cap rate, but it’s not enough to evaluate the property.

Variation in any one factor can make significant changes in the capitalization rate, which the investor aims to get. Cap rate is a crucial metric for comparing similar properties, such as in a similar location or similar age. Despite the drawbacks, analysts and investors widely use this metric to decide on a profitable investment opportunity. However, an investor or analyst must not solely depend on the cap rate to make their real estate investment decision, instead use other methods as well. Cap rate can change as long as investors understand how to boost the NOI.

Sales comparable show what similar properties are selling for to help estimate a current market value of the property under consideration. Here we offer a brief explainer of what cap rate is, how it’s calculated, its limitations, and how you can apply it to your investment decisions. The cap rate calculation doesn’t work for every investor and situation.

Under capitalization is a situation when the company does not have sufficient capital to conduct normal business operations and pay creditors. In the words of Hoagland, “whenever the aggregate of the par values of stocks and bonds outstanding exceed the true value of fixed assets of the corporation, it is said to be over capitalized”. Over capitalization is a situation when the company raises more capital than required for its level of business activity and requirements. Business activity here represents the routine operations of the business.