Contents

Updated pattern list, added titles to plots and shapes, more options. The BC rollback should form at levels from 0.382 to 0.886 levels. Pay 20% or “var + elm” whichever is higher as upfront margin of the transaction value to trade in cash market segment. ABCD is a strong pattern with significant risk/reward opportunities.

I was always scared about making money online because they always seemed to be scams. I however decided to try this out and made an account on Olymp Trade. I traded for a few days using the demo account and then after I felt confident I decided to invest a small amount of money into trading cryptocurrency with real money.

How accurate are harmonic patterns in forex?

The reversal can push the price to previous level first 938 and 980. Bullish Butterfly pattern required “B” mid-point 78.6% retracement and The price can fall 1.27. Take a look at articles from our blog to get started with examples of patterns found by PatternSurfer’s algorithms. Have a look at this image to understand the ABCD pattern which can be used in your trading techniques.

The ABCD pattern is extremely easy to follow and is great because so many traders still follow it. The pattern begins with identifying point A, the initial spike, which is a significant high. It indicates the market is in control of the bull, who is aggressively buying and pushing the market sentiment up. However, once the asset price reach day’s high and traders start to sell, we see a healthy pullback. Once the selling force takes over, we get the intradaylow at point B.

How to trade in ABCD pattern

Larry Pesavento has improved this sample with Fibonacci ratios and established guidelines on how to trade the “Gartley” sample in his guide Fibonacci Ratios with Pattern Recognition. With over 50+ years of combined buying and selling expertise, Trading Strategy Guides presents buying and selling guides and assets to coach traders in all walks of life and motivations. We concentrate on educating traders of all skill levels the way to trade stocks, choices, forex, cryptocurrencies, commodities, and extra. It is essential to notice that patterns could exist inside different patterns, and it’s also potential that non-harmonic patterns may exist inside the context of harmonic patterns.

Is Bitcoin in a Bear Flag?

The bear flag of Bitcoin means there is an upside-down pattern on its price chart. Crypto investors should be ready for the breakdown of BTC at any point in time. The breakdown will be experienced if the cryptocurrency price finished below the lower end of the bear flag at the end of a trading date.

Hence, Harmonic sample trading has many extra positives than different buying and selling methods. All 5-level harmonic patterns have comparable rules and constructions. Though they differ in terms of their leg-length ratios and locations of key nodes , once you understand one sample, it is going to be comparatively easy to know the others. It could assist for merchants to use an automatic sample recognition software program to establish these patterns, somewhat than using the bare eye to seek out or pressure the patterns. The major principle behind harmonic patterns relies on value/time movements which adhere to Fibonacci ratio relationships and its symmetry in markets. As you may already know, Fibonacci numbers may be seen all around us within the pure world, and these harmonic ratios are additionally present inside the financial markets.

Also please confirm can we scan this existing AFL to find which patterns are formed.withI am eagerly awaiting for your fruitful response. Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events.

Fusion Mediawould like to remind you that the data contained in this website is not necessarily real-time nor accurate. But for such prophecy to work, the patterns should be very clear and goal. So, my conclusion is that harmonic patterns merely do not work, they are not profitable over long term, they provide no edge.

Confluences For Best Trade Setups

When the confluence of the three occurs, traders take a position to go long in the market. Fibonacci ratios are referred to many times in trading and Report conclusion investment strategies. Traders believe these ratios influence the financial market and can help determine a possible outcome of a trade set-up.

• abcd pattern indicator is used to indicate strength trend in the trade. Occasionally, the data recorded onto these price charts form patterns. A pattern is simply a recognizable configuration of price movement. These distinctive formations form the basis of what we call technical analysis. The bearish pattern begins with a strong upward move – initial spike , during which buyers are aggressively buying thus pushing the stock price to it high-of-day.

What is the dirty flag pattern?

The Pattern

A “dirty” flag tracks when the derived data is out of sync with the primary data. It is set when the primary data changes. If the flag is set when the derived data is needed, then it is reprocessed and the flag is cleared. Otherwise, the previous cached derived data is used.

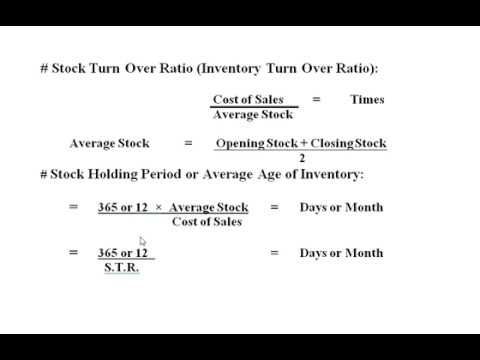

Let’s explain the ABCD pattern, but before delving deep into the topic, let’s touch upon Fibonacci retracement, which lays the foundation of ABCD pattern. At the End-of-Day, End-of-Week or End-of-Month, ChartAlert® can scan or screen symbols based on the in-built Renko Pattern detection or Renko Pattern recognition algorithms … At the End-of-Day, End-of-Week or End-of-Month, ChartAlert® can scan or screen symbols based on the in-built https://1investing.in/ P&F Pattern detection or P&F Pattern recognition algorithms … At the End-of-Day, End-of-Week or End-of-Month, ChartAlert® can scan or screen symbols based on the in-built Harmonic Pattern detection or Harmonic Pattern recognition algorithms … At the End-of-Day, End-of-Week or End-of-Month, ChartAlert® can scan or screen symbols based on the in-built Chart Pattern detection or Chart Pattern recognition algorithms …

Harmonic Patterns AFL Code for Amibroker

We sell or buy immediately after a rebound from the level of 1.272, place a stop immediately below the next high or low, and close the trade in profit when the point C is reached. The main rule of the symmetric ABCD pattern is that the segments AB and CD should be approximately equal , both in terms of price levels and in terms of formation time. But, in practice, it often happens that the segments have different lengths – this is also acceptable, but it will be more difficult to perform trading with such figures.

- With the Olymp Trade Platform you can start trading with a minimal amount of investment.

- The BC rollback should form at levels from 0.382 to 0.886 levels.

- Life seemed merely a succession of bills and worrying about how to pay them.

- Let’s find out how the ABCD pattern can help you understand the market and trade more efficiently by making more precise asset price predictions.

- Although, there’s another important step to study before defining the Cypher pattern buying and selling technique rules.

It can be used to amplify trading strategies by making more informed decisions on entry and exit points. Like most technical indicators, its signals are most reliable when they conform to a long-term trend. I’d just like to add my story, I think others would like to hear it.

Trading Services : Must Check

I would not say this is an expert guide to harmonic patterns, but rather a normal, or intermediate guide to harmonic patterns. Mostly it shows the Fibonacci retracements which everybody already knows. But the difference here is, people “know” fib retracements, but this book will help to start “understanding” fib retracements. And also the various Fibonacci related patterns are shown with the help of examples from Indian equity, U.S. equity, forex, commodities. Mostly, all those patterns follow the ABCD patterns, but the difference in their price action brings forth a derivations of patterns within the AbCD pattern. All in all a good book, must read for people who don’t know or understand the golden ratio or fib..

The MACD proves most effective in a widely swinging market, whereas the RSI usually tops out above the 70 level and bottoms out below 30. It usually forms these tops and bottoms before the underlying price chart. The Calculator can estimate the exact volume of a transaction to enter the market with an acceptable potential risk level. Identifies instances when excessive amounts of candles have closed in the same direction.

This nonetheless remains after 5 years on this strategy of buying and selling these 2 harmonic patterns. And in case you are attempting to take each single pattern that comes your means, you will fail. As we can see from the above, the ABCD pattern is a simple harmonic pattern that appears on the price charts frequently. The ABCD is a recurring pattern that is repeated over and over in the price charts, with each of the patterns qualify any of the rules mentioned above forming any of the 3 patterns. Learning and spotting chart patternsin the stock market is a popular hobby amongst day traders of all skill levels.

There are several ways to do this, including using chart tools. It is because the Fibonacci levels are often looked at as areas of interest. Therefore, the best course of action is to hold the trade further until the price breaks one of its support levels. Aarti industries is a fundamentally strong bullish stock is in the best possible correction zone following the three drive pattern. As per my analysis this is the best time to buy as it is near 1.618 retracement phase.